FedNow Request Payments

TodayPayments.com is the go-to fintech

platform for FedNow® and RTP® Request for Payment automation across all

B2B, C2B, and A2A scenarios.

We specialize in

alias-driven invoicing, ISO 20022-rich data integration, batch uploads,

and guaranteed real-time settlement. Built for speed and compliance,

our tools eliminate payment delays while enhancing identity trust,

reconciliation accuracy, and funding certainty.

Merchants, service providers, and finance teams trust us to modernize their payment workflows — one “good funds” transaction at a time.

FedNow® Request Payments for Recurring, Batch, and Instant Transactions

![]() The future of billing is instant, secure, and

smart. With FedNow® Request for Payments (RfP) and RTP®

interoperability, U.S. businesses now have the power to automate

recurring, static, or variable payments across all B2B, C2B,

and A2A use cases — all in real time.

The future of billing is instant, secure, and

smart. With FedNow® Request for Payments (RfP) and RTP®

interoperability, U.S. businesses now have the power to automate

recurring, static, or variable payments across all B2B, C2B,

and A2A use cases — all in real time.

At TodayPayments.com, we help organizations simplify this process with ISO 20022-rich messaging, identity-verified aliases, mobile-first invoicing, and guaranteed credit settlement. Whether you’re sending one invoice or uploading a thousand, FedNow® RfP delivers secure “Good Funds” faster than ACH or checks ever could.

Using FedNow® or RTP® Request for Payment, businesses can initiate real-time transactions with full visibility and identity verification. Whether you’re handling one-by-one invoices or batch uploads, the FedNow® Service offers scalable, secure, and instant settlement.

Benefits:

- Request payments via email, text, or digital invoice links

- Enable static or variable recurring billing

- Automate one-time or bulk batch payment requests

- Confirm identity with Confirmation of Payee

- Guarantee real-time settlement across all U.S. banks and credit unions

No more waiting days for ACH. No more risk of reversals. Just guaranteed, real-time “good funds.”

Smart A2A Payments with Alias Support and ISO 20022 Messaging

With TodayPayments.com, you can leverage account-to-account (A2A) transfers using alias-based identifiers like email addresses and mobile numbers. Our platform supports all major file formats and messaging specifications for complete FedNow® and RTP® network interoperability.

Features:

- Use aliases for both payee and payer — email, phone, or business ID

- Upload .Excel, .XML, and JSON files for batch processing

- Generate ISO 20022-compliant Request for Payment (RfP) messages

- Route payments to any credit union or bank in the U.S.

- Trigger push or pull transactions with real-time confirmation

- Automate mobile, SMS, and email invoicing at scale

Whether you're a SaaS firm, utility provider, or service-based business, this technology powers fast, frictionless financial workflows.

From Identity to Instant Settlement — Powered by the FedNow® and RTP® Networks

FedNow® RfP is about more than speed. It’s about trust, visibility, and flexibility. With Confirmation of Payee, your business validates every recipient’s identity before funds move — drastically reducing fraud and errors.

Why It Works:

- ✅ Real-time payments with guaranteed funds

- ✅ Alias-based identity mapping — no need to share sensitive account info

- ✅ Support for B2B, C2B, and A2A transactions

- ✅ Use mobile-first invoicing: SMS, email, QR code, hosted links

- ✅ Smart messaging with ISO 20022 standards

- ✅ Works across FedNow® and RTP® networks for full U.S. coverage

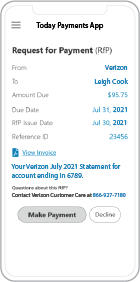

FedNow Request Payments e-invoicing through the Instant Payment Service would involve several key elements:

1. Invoice Generation: Businesses or individuals generate invoices specifying the details of the payment request, including the amount owed, due date, invoice number, and any relevant billing information.

2. Payment Request: The invoice is converted into a payment request using the FedNow Request Payments system. This payment request includes all relevant invoice details and is sent to the payer electronically.

3. Payer Notification: The payer receives a notification alerting them to the payment request. This notification may be sent via email, text message, or through their banking app, depending on the communication preferences set by the payer.

4. Payer Authorization: The payer reviews the payment request and authorizes the payment through their banking app or online banking portal. This authorization confirms their consent to initiate the payment.

5. Instant Funds Transfer: Once authorized, the payment is processed through the FedNow Instant Payment Service, facilitating the immediate transfer of funds from the payer's account to the payee's account in real-time.

6. Confirmation: Both the payer and the payee receive instant confirmation of the transaction once it's processed. This confirmation provides assurance that the payment has been successfully initiated and settled.

7. Recordkeeping: Transaction details, including the payment request, authorization, and confirmation, are recorded and stored electronically by both parties for reconciliation and accounting purposes. This ensures accurate financial records and facilitates easy tracking of payments.

8. Security Measures: Robust security measures are employed throughout the process to protect sensitive financial data and prevent fraud. Encryption, authentication, and other security protocols ensure the safety and integrity of payment transactions.

By leveraging FedNow Request Payments e-invoicing through the Instant Payment Service, businesses can streamline their invoicing and payment collection processes, offering convenience, speed, and security for both payers and payees.

One Request. One Click. Real-Time Funds.

Imagine sending a payment request and getting

real-time confirmation — with no reversals, no delays, and no bank

visits.

That’s what you get with TodayPayments.com + FedNow® RfP.

✅ One-time, recurring, or batch

transactions

✅ Identity-secure alias billing

✅ Real-time settlement with ISO 20022 RfPs

✅

Compatible with all U.S. banks and credit unions

✅

24/7 onboarding + mobile-first invoicing

👉 Ready to request and receive

good funds instantly?

Get started now at

TodayPayments.com — where your payments move at the speed

of trust.

Creation Recurring Request for Payment

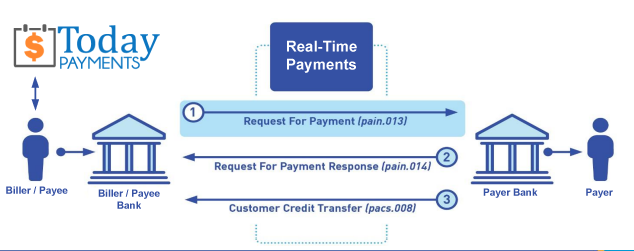

We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-TimePayments.com to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", either FedNow or RTP, will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

ACH and both Instant and Real-Time Payments Request for Payment

ISO 20022 XML Message Versions

The versions that

NACHA recommends for the Request for Payment message and the Response to the Request are pain.013 and pain.014

respectively. Version 5 for the RfP messages, which

The Clearing House Real-Time Payments system has implemented, may also be utilized as

there is no material difference in the schemas. Predictability, that the U.S. Federal Reserve, via the

FedNow ® Instant Payments, will also use Request for Payment. The ACH, RTP ® and FedNow ® versions are Credit Push Payments.

Payees ensure the finality of Instant Real-Time

Payments (IRTP) and FedNow using recurring Requests for

Payments (RfP), Payees can implement certain measures:

1.

Confirmation Mechanism:

Implement a confirmation mechanism to ensure that each

payment request is acknowledged and confirmed by the payer

before the payment is initiated. This can include requiring

the payer to provide explicit consent or authorization for

each recurring payment.

2.

Transaction Monitoring:

Continuously monitor the status of recurring payment

requests and transactions in real-time to detect any

anomalies or discrepancies. Promptly investigate and resolve

any issues that arise to ensure the integrity and finality

of payments.

3.

Authentication and

Authorization: Implement strong

authentication and authorization measures to verify the

identity of the payer and ensure that only authorized

payments are processed. This can include multi-factor

authentication, biometric verification, or secure

tokenization techniques.

4.

Payment Reconciliation:

Regularly reconcile payment transactions to ensure that all

authorized payments have been successfully processed and

finalized. This involves comparing transaction records with

payment requests to identify any discrepancies or

unauthorized transactions.

5.

Secure Communication Channels:

Utilize secure communication channels, such as encrypted

messaging protocols or secure APIs, to transmit payment

requests and transaction data between the payee and the

payer. This helps prevent unauthorized access or

interception of sensitive payment information.

6.

Compliance with Regulatory

Standards: Ensure compliance with

relevant regulatory standards and guidelines governing

instant payments and recurring payment transactions. This

includes adhering to data security requirements, fraud

prevention measures, and consumer protection regulations.

By implementing these measures, Payees can enhance

the finality and security of Instant Real-Time Payments

using recurring Requests for Payments, thereby minimizing

the risk of payment disputes, fraud, or unauthorized

transactions.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing